The selected startups will receive support to develop their businesses and achieve their inclusion goals, creating synergies between them, partners, sponsors, investors, microfinance institutions and public financial institutions

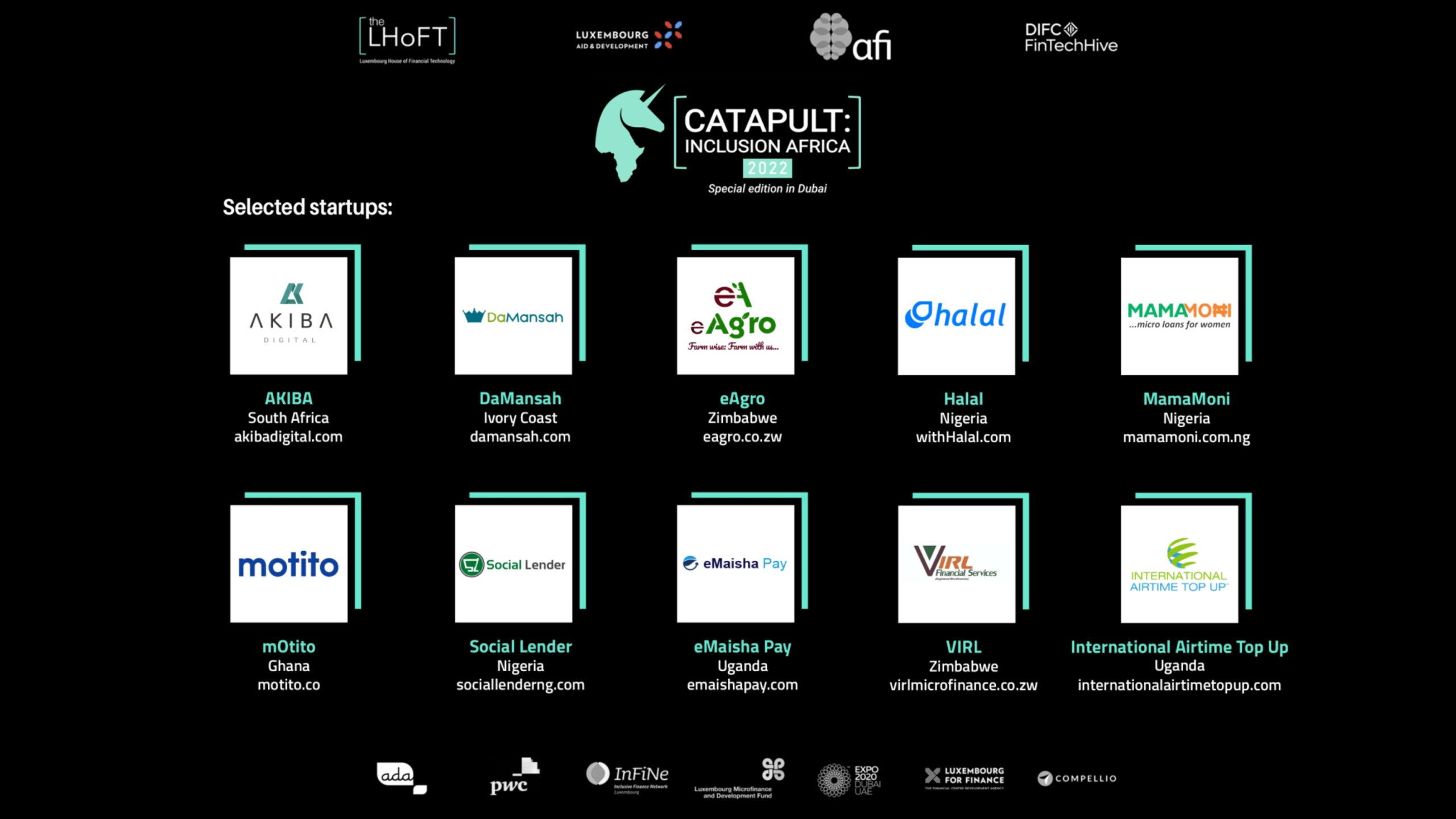

From across Africa, 10 fintech startups have been selected to participate in the CATAPULT: Inclusion Africa programme designed for innovative technology companies focused on financial inclusion.

Organised by LHoFT Foundation, this special edition of the CATAPULT: Inclusion Africa is sponsored by the Ministry of Foreign & European Affairs – Directorate for Development and Humanitarian Affairs, and receives support from the Alliance for Financial Inclusion as well as other key strategic partners such as ADA, AFI, InFine, DIFC FinTech Hive, PwC, Luxembourg Microfinance and Development Fund, Luxembourg For Finance, Dubai UAE Expo 2020 and Compellio.

The startups selected to participate in the CATAPULT: Inclusion Africa 2022 include:

Located in Johannesburg, South Africa, Akiba Digital was founded in January 2018. The startup enables lenders to better extend capital to small businesses and individuals, providing nuanced credit insights and real-time lending decisions. Using alternative datasets to provide inclusive scores, Akiba’s methods allow lenders to score people and small businesses that cannot be reached by traditional credit bureaus – a problem that affects nearly 80% of small businesses and individuals in Africa.

2. Damansah

Founded in May 2019, Damansah is located in Abidjan, Ivory Coast. The fintech company is building an alternative credit scoring infrastructure that makes connections between credit providers and small businesses/customers easier, leveraging technology to increase the growth rate of SMEs in Africa.

The Nigerian-based startup launched operations in February 2016. Social Lender helps financial institutions to offer services based on social reputation to individuals who are underbanked or have little or no access to formal financial services. The solution is designed to bridge the gap of immediate fund access for people with limited access to formal financial services.

Social Lender uses its own proprietary algorithm to perform a social audit of the user on social media, online and other related platforms and gives a Social Reputation Score to each user. Financial Services are guaranteed by the user’s social profile and network, allowing users to then borrow from banks and other financial institutions based on their social reputation.

Also based in Lagos, Nigeria, MamaMoni Limited, provides micro-business loans to low-income women in rural and urban areas in Nigeria, catering for those who ordinarily cannot be served by the formal credit system. Founded in February 2015, the startup offers fast and simple loans that enable low-income women to build, grow and sustain their businesses. Added to this, the company also supports them with digital and financial literacy training.

5. eAgro

Located in Harare, Zimbabwe, eAgro uses data analytics and machine learning to create low-cost financial credit products tailored to unbanked and underserved farmers’ needs. Having started operations in March 2020, the company focuses on bridging the critical gap between financial institutions such as banks, MFIs, contract farming organisations, government agencies, among others, from availing financial products.

eAgro is pioneering financial inclusion for unbanked smallholder farmers in SADC. Through its proprietary algorithm, the startup is able to analyse relevant data sets and produce farmers’ financial health status that helps them improve their farming practices, and bolster their incomes over time through inclusive credit packages.

6. eMaisha Pay

eMaisha Pay is a mobile platform that leverages machine learning, alternative data and psychometric parameters to credit score SMEs in Africa, empowering them with quick, affordable and non-collateral working capital for business growth.

Located in Kampala, Uganda, eMaisha’s use of alternative data and advanced psychometric analytics is helping the startup eliminate the information asymmetry, hence generating additional information to assess the credit risk of SMEs. Since its founding date in May 2019, the startup has built itself to a level where its credit scoring model makes it possible to serve SMEs that had no access to finance in the past.

eMaisha Pay seeks to transform the traditional lending process by automating customer onboarding, loan origination, decisioning, disbursement and loan servicing tasks.

7. mOtito

Buy-Now-Pay-Later startup, mOtito is a Ghana-based fintech company specifically located in Accra. It was founded in August 2021 with a goal to provide interest-free credit at point-of-sale for the African market. mOtito focuses on offering the convenience of payment plans that give businesses a huge advantage, increasing customer satisfaction and retention.

Halal Payment is a Lagos-based fintech company founded in November 2021. The all-inclusive digital payments service platform leverages on Islamic banking system to provide shariah based financing for Small and Medium Enterprises (SMEs) to scale their businesses, create jobs, alleviate poverty and enhance economic productivity at large.

9. VIRL Rural & Social Financial Services

VIRL Rural & Social Financial Services provides loans to smallholder farmers, micro and small enterprises. The startup is located in Harare, Zimbabwe and was founded in February 2010. So far, the company has built five loan products including working capital, inputs, assets finance, value chain and life enhancement loans targeted at smallholder farmers, micro and small enterprises.

With 34 staff and 6 branches mostly in rural areas, VIRL provides tailor-made loans that seek to enhance business operations and, in turn, improve livelihoods for rural communities and those in urban areas who would otherwise have no access to funding.

10. International Airtime Top Up

Uganda-based International Airtime Top Up is an inclusive and registered ICT and Mobile Financial services company that has been in operation since 2014. It helps increase financial inclusion both locally and globally with simple, scalable and sustainable solutions.

Through its International Top Up Gateway technology, the fintech combines cross-network/border airtime, mobile money and bank low-cost transfers across the world with over 80 destination currencies supported. The startup was among the Uganda Country Finalists 2019 at the (anti) DataHack4FI Innovation Award sponsored by MasterCard Foundation.